Photo: James Ray Spahn / If you need more space, whether to take in an aging parent or provide quarters for adult kids returning to the roost, an accessory dwelling unit (ADU) can accommodate and give everyone a bit of privacy in the process.

Change is the only constant in life, so the saying goes. But how can you account for the unknown as you’re building a seemingly rigid structure like a home? It is possible to design a house that can flex with you as your circumstances change. Consider these 10 factors as you plan your forever home.

1. Family matters.

Young couples designing a new home can look forward to many changes as their lives evolve. Maybe all you need right now is a master bedroom and a guest room. If kids enter the scene, you could be looking for additional bedroom space.Plan ahead for more bedrooms by choosing attic trusses that afford extra headroom on an upper level. You don’t need to finish out the attic space right away, but you’ll know it’s an option should the need arise. Adding a long shed dormer to an attic space also can create the headroom needed for bedrooms. Talk to your designer now about the possibility of an upstairs bathroom later — perhaps even installing rough-ins for plumbing lines, which is far easier to accomplish during construction than it is to retrofit.

Keep in mind, however, that if you have a large enough lot, expanding outward instead of upward is less disruptive (though often more expensive) while you’re living in the home. Discuss with your designer now where a new space could connect with the original structure. A window can be converted into a doorway, but choose a larger window or group windows together at the outset so you don’t end up with a door that’s too narrow. To make room for a connecting hall, could you plan for space to be taken away from a room on the original plan and still allow that smaller room to be usable? Consider all the possibilities.

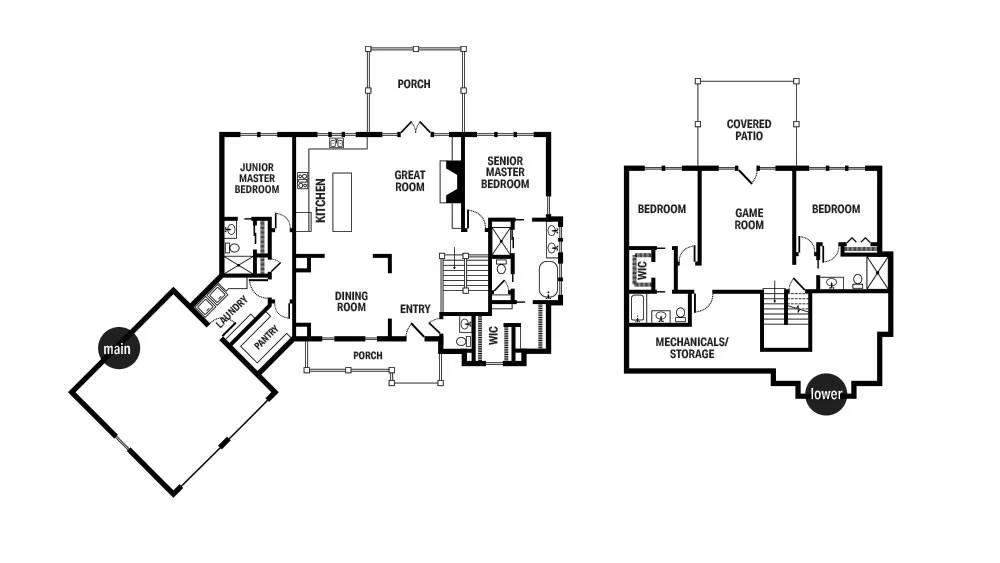

2. Accommodating multiple generations.

At some point, you might open your home to an aging parent or welcome an adult child back under your roof. If you can foresee this situation, discuss options with your designer or architect now. For instance, could a basement be primed for a kitchen, living room, bedroom and bath? If you envision a bedroom suite for extended family, would you prefer to share a kitchen and laundry facilities? And could you add in-floor radiant heating to your basement slab as it’s poured to make that space cozy when it’s needed?

You also might consider an accessory dwelling unit (ADU) or guest house. This arrangement offers the advantage of keeping relatives close while offering privacy to all parties. Before setting your heart on an ADU, find out if there are restrictions against them in the area where you plan to build or if your lot is large enough for more than one building, given setback restrictions. If you have the green light, plan ahead for how electricity, water and sewer lines will be run to a detached building.

FabCab photo by Marie-Dominique Verdier / A secondary mini-kitchen is perfect for renters or extended family members. In the meantime, it can be a fantastic auxiliary entertaining spot.

3. Supplemental income through renters.

Maybe you want to include a separate living space in your home and use it to generate extra income. Whether you rent on a long-term basis or for short-term vacation stays, plan ahead with a separate entrance.

Other factors: Will you need to arrange for separate utility connections so billing a tenant is simple? Do you want to share outdoor living areas with renters, or could you create separate spaces? Consider is the possibility of shifting the separate suite back to being part of the main house in the future. Would you need to add interior stairs? If so, allow for that in your initial plans.

4. Home as office.

Now more than ever, work life and home life are overlapping. Can you predict what your home office needs might be in the next few years? One way to remain flexible is to plan nooks or niches that could serve as office or workspaces whenever you might need them. Expanded stair landings, alcoves, lofts or even an oversized closet could flex to accommodate a desk, chair and some storage. Be sure to provide adequate lighting and electrical outlets in those areas.

Looking ahead to retirement? Think about how your home office could morph into a hobby space for an activity you enjoy when you stop working.

Montana Log Homes, Photo by Heidi Long / Now more than ever, work life and home life overlap. If you need a home office now, think about what other functions this space can perform upon retirement. Then, work with your designer to ensure that conversion will be seamless when the time comes.

5. Going up?

Mobility might not be an issue for you now, but in the future, navigating stairs could be challenging. It’s relatively simple to plan ahead for a residential elevator, and the costs have come down. Ask your designer or architect to stack closets on each level so a future shaft can be installed. Don’t forget: You’ll need to account for the future elevator’s electrical requirements, too.

6. The stuff of life.

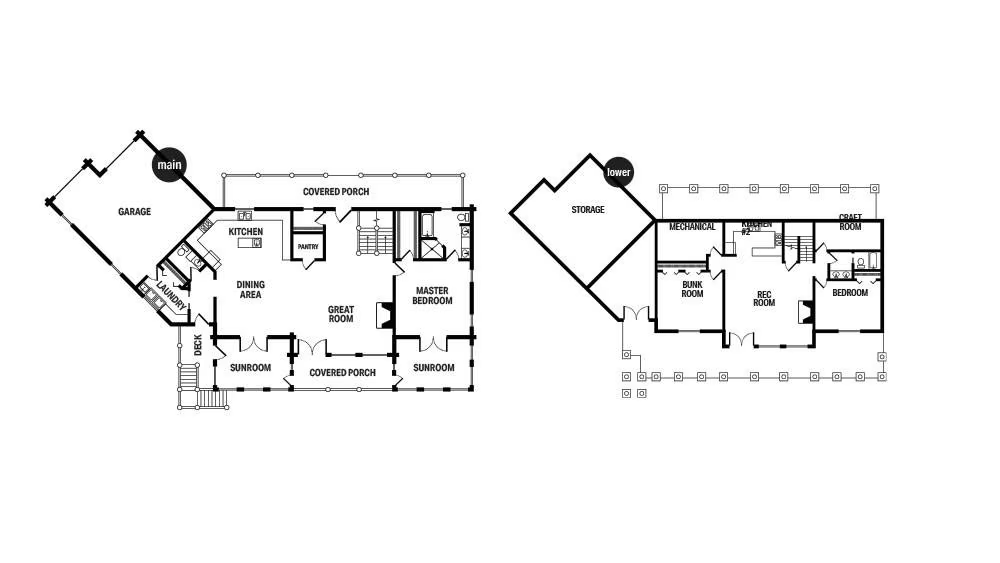

It seems the longer you live in a house the more things you accumulate. The need for storage can become acute when you plan a home as a vacation place, but then move to it full time. Suddenly, skimpy vacation-home closets are overflowing. How will your storage needs change over time? If you plan to finish a basement or attic, can some areas be left for storage? Will you add an outbuilding for storage? Plan ahead for bringing electricity to that space.

7. Aging in place.

If you plan to stay in your new log or timber frame home for the foreseeable future, follow the rules of universal design. Wide hallways, generous doorways and curbless showers can accommodate a walker or wheelchair. Lever-style door handles and pulls instead of knobs are kinder on arthritic hands. A bedroom and full bath on the first floor can be used for guests or as office space now and then a master suite down the line. An online search for universal design concepts will provide plenty of factors to consider — and help you create a true forever home.

8. Be open-minded.

The beauty of an open concept plan with areas defined by posts is that it allows for non-load bearing partition walls to be added or removed as needs change. Bedrooms you need with children at home could be converted to open areas when they move out. Or, a first-floor bedroom or office could be created, if need be, out of large great room space.

9. Keeping up with tech.

It’s almost impossible to predict how technology will change our lives at home over the coming decades. Instead, you can plan to be flexible. For now, wired Ethernet in your home (even in the garage) or mesh WiFi can help you connect truckloads of smart home gadgets. Even if you have no desire for a toaster, shower or refrigerator that remembers your personal preferences, this extra wiring or WiFi coverage could come in handy in the future.

10. Changing a log home.

With a log home it can be tricky to attach a full-log addition. Matching stain and accounting for settling of the new logs where they attach to existing log walls present some challenges. While it’s not impossible, it might be easier to add a semi-attached (e.g., via a breezeway or gallery) timber structure or a conventionally framed addition encased in a complementary material like stone, corrugated metal or log siding, if you want to continue the log look.

While no one has a crystal ball, it’s worth your while to imagine your future lifestyle, then see how the home you build today might accommodate it for years to come.

Benefits of Putting a Home into Trust

A living trust, often referred to as an inter vivos trust, allows you to control the use, transfer, ownership and funding of your home during your lifetime and upon your death. The trust — not you or your children — owns the house.

The trustee manages assets on behalf of the beneficiaries. You may act as both trustee and beneficiary. When you die, the remainder of the trust passes to those you name as beneficiaries to be managed by the person you appoint as trustee. This arrangement offers several advantages, including protecting the home from creditors; managing future expenses, including the mortgage and taxes; and keeping the peace in the family.

Plans for the Ages

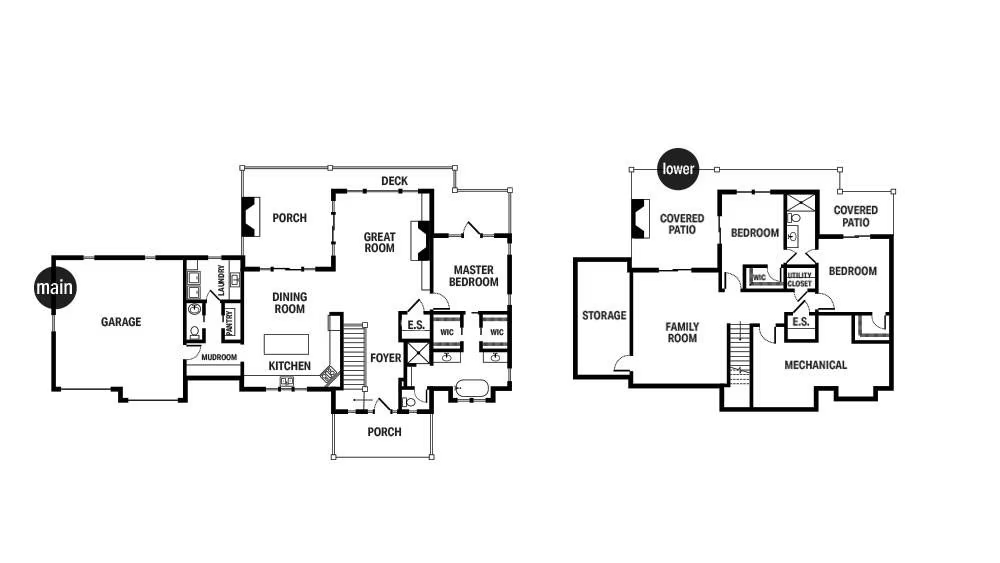

Eagle’s Nest

By adding an elevator, you’ll provide older family members or those with mobility issues easy access to all areas of the home. Residential elevators have come down in price significantly and don’t need to be installed right away. Stacked closets (marked as E.S. on each level of this plan) can be converted to an elevator shaft when the time comes.

Leaving Your Legacy

Adobe ©LIGHTFIELD STUDIOS

Preserving your house for future generations requires planning. In your heart, a legacy home belongs to your entire family. However, only the deed-holders are the true legal owners, and the form of ownership affects their rights to the property.

Tenants by the Entirety.

Married couples typically hold real property as tenants by the entirety. Under this type of deed, you and your spouse are equal owners, so when one dies, the other retains ownership. But many couples don’t consider that a surviving spouse may remarry, and if the surviving spouse then dies or divorces, his or her current spouse may have a claim to the property.

Joint Tenants with Right of Survivorship.

In this model, two or more people have an undivided, 100% interest in the property. When one owner dies, the other owners absorb the decedent’s interests. For example, if you were to deed the property to two siblings as joint tenants, the one to die first could not bequeath the house to her or his family, but instead the surviving sibling would acquire sole ownership, and the house would pass down that line.

Tenants in Common.

Tenants in common own individual shares in the property, which may be of unequal size and can be transferred to third parties through sale or inheritance. The percentage owned by one child could be subject to a creditor’s lien if the child acquires a large debt — a circumstance that could put the property in jeopardy. And, your child’s spouse could claim his or her share, should they divorce.